Germany's economic landscape is facing unprecedented challenges as the number of corporate insolvencies reaches a 20-year high. According to the Leibniz Institute for Economic Research Halle (IWH), April saw 1,626 insolvencies among personal and capital companies, marking an 11% increase from the previous month and a 21% rise compared to the same period last year. This surge not only reflects the current economic strain but also surpasses the peak levels observed during the 2008/2009 financial crisis.

The recent data highlights the growing pressures on businesses, including expensive energy, bureaucratic hurdles, political uncertainty, and consumer restraint. The expiration of state aid measures, initially implemented to mitigate the pandemic's impact, has further exacerbated the situation. These factors collectively contribute to the highest insolvency figures since July 2005, signaling a critical juncture for Germany's corporate sector.

Steffen Müller, head of IWH's insolvency research, notes an unusual prevalence of smaller insolvency procedures in the recent data. He suggests that if the proportion of these smaller cases returns to the long-term average, insolvency numbers may begin to decline in the coming months. However, Müller anticipates that Germany will continue to experience more corporate failures than in the previous year, underscoring the lingering effects of the current economic downturn.

The IWH's early indicators, which track insolvency trends two to three months in advance, rely on monthly insolvency announcements linked with corporate balance sheet data. This methodology provides a forward-looking perspective on the insolvency landscape, offering insights into the potential trajectory of Germany's economic recovery. As businesses navigate these turbulent times, the coming months will be crucial in determining whether the current trend represents a temporary spike or the beginning of a more prolonged period of financial instability.

Germany is currently experiencing an intense heatwave, with temperatures expected to reach up to 40 degrees Celsius on Wednesday, marking the peak of this summer's heat, according to the German Weather Service (DWD). The heatwave, originating from Spain and France, has also led to...

German actor and musician Jimi Blue Ochsenknecht has been issued an extradition arrest warrant nearly a week after his initial detention, marking a significant development in a legal saga stemming from unpaid hotel bills. A spokesperson for the Hamburg Public Prosecutor's Office confirmed the...

Former German Chancellor Angela Merkel has publicly criticized the current government's approach to handling asylum seekers at the country's borders. Merkel emphasized the importance of providing an asylum procedure to anyone who requests it at the border, aligning with her interpretation of...

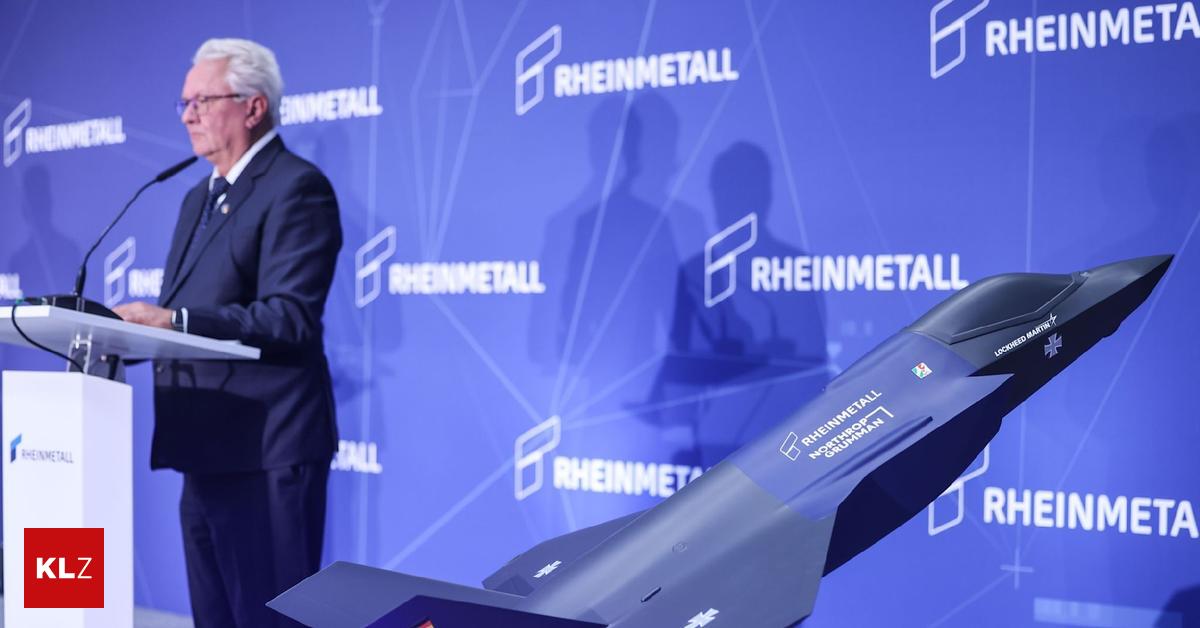

Rheinmetall, Germany's largest defense contractor, has marked a significant milestone in its aviation sector expansion by commencing production of fuselage center sections for the F-35, the world's most advanced stealth fighter jet. This development comes as part of a collaboration with US...

Northern Germany experienced significant disruptions to its rail services, with multiple incidents including embankment fires, an overhead line fault, and the disposal of an unexploded World War II bomb near Osnabrück's main station causing widespread delays and cancellations. The Deutsche...